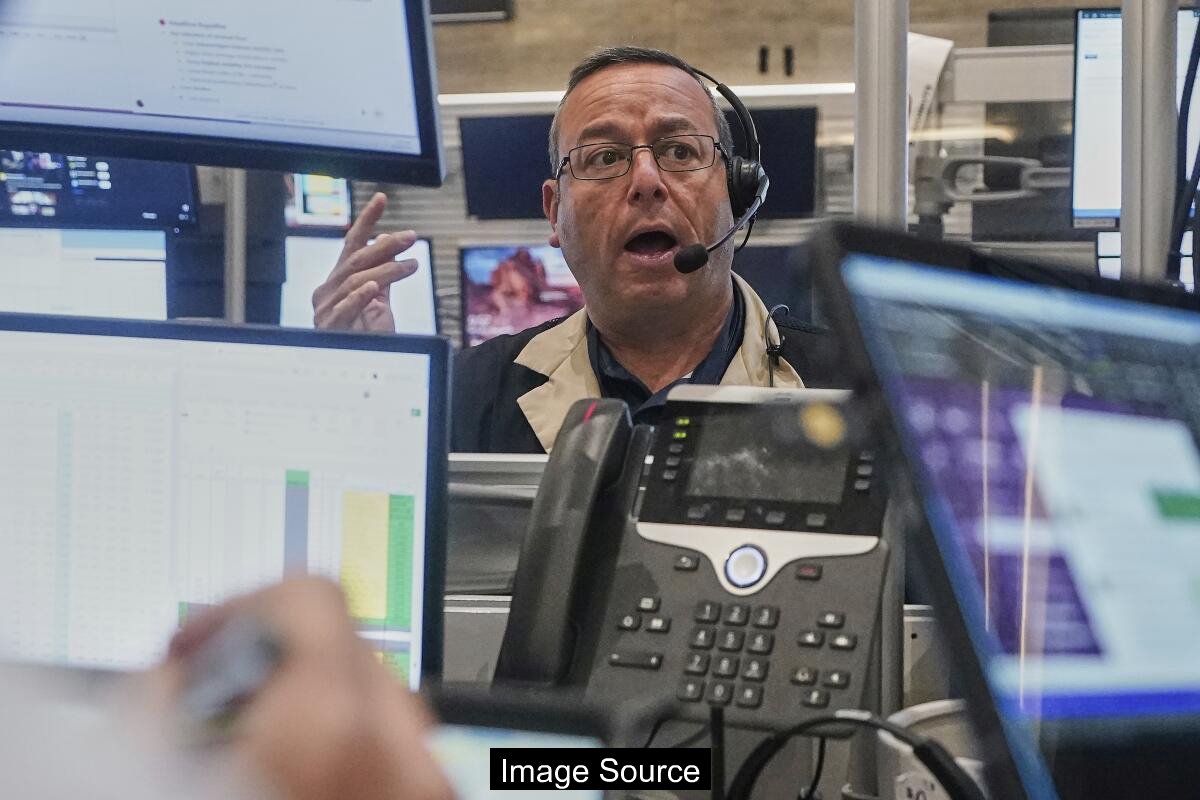

U.S. inventory indexes pulled again on Wednesday after reaching all-time highs in latest buying and selling periods. The retreat got here as traders paused to evaluate latest company earnings studies and ongoing financial indicators which were driving market sentiment.

Market Efficiency Overview

Wall Road concluded August with a blended efficiency, marking its fourth consecutive month of positive factors. The S&P 500 skilled a 0.6% decline, but maintained a 1.9% month-to-month acquire and a powerful 9.8% year-to-date development. The Dow Jones industrial common and Nasdaq composite additionally noticed modest pullbacks, reflecting a nuanced buying and selling atmosphere.

Merchants approached the lengthy Labor Day weekend cautiously, decreasing market publicity to mitigate potential weekend information dangers. Sam Stovall from CFRA famous that merchants sometimes keep away from substantial positions earlier than prolonged vacation intervals to stop sudden market disruptions.

Combined financial indicators contributed to the market’s subdued efficiency. A carefully watched inflation measure and shopper sentiment survey recommended ongoing financial uncertainties, prompting some traders to take earnings after latest market milestones.

Know-how Sector Dynamics

Know-how shares skilled notable declines, offsetting positive factors in different sectors. Dell Applied sciences led the S&P 500’s downward motion, dropping 8.9% following its quarterly income report. Main tech firms like Nvidia, Broadcom, and Oracle additionally registered vital losses.

The sector’s efficiency mirrored ongoing challenges, together with margin pressures and weakening PC income. Traders remained delicate to particular person firm efficiency and broader technological market tendencies.

Regardless of short-term volatility, the expertise sector continues to play an important position in total market dynamics, with investor sentiment carefully tied to company earnings and forward-looking steerage.

Inflation and Federal Reserve Insights

The Commerce Division reported a 2.6% worth enhance in July in comparison with the earlier yr, per June’s figures. Core inflation, excluding meals and power, rose to 2.9%, the best since February, although considerably decrease than the roughly 7% peak three years in the past.

Federal Reserve Chair Jerome Powell signaled potential rate of interest cuts on the upcoming assembly, citing indicators of job market sluggishness. Merchants presently estimate an 87% chance of a quarter-percentage-point fee discount.

Decrease rates of interest may stimulate funding and financial exercise by decreasing borrowing prices. Nevertheless, policymakers should rigorously stability potential financial advantages in opposition to the danger of reigniting inflationary pressures.

Shopper Sentiment and Market FAQ

The College of Michigan’s shopper sentiment survey revealed heightened financial considerations. August’s remaining studying marked the bottom level since Might, reflecting ongoing apprehensions about pricing and financial stability.

Q1. What components are influencing shopper sentiment?

A1. Key drivers embody persistent inflation, job market uncertainties, and broader financial indicators.

Q2. How may rate of interest adjustments influence shopper confidence?

A2. Potential fee cuts may present financial stimulus, probably bettering shopper outlook and spending patterns.

Strategic Pointers

Particular person inventory performances diverse extensively, with firms like Petco Well being & Wellness and Autodesk reporting sturdy quarterly outcomes. Conversely, Ulta Magnificence and Marvell Know-how skilled vital inventory worth declines regardless of assembly or exceeding sure monetary expectations.

Treasury yields demonstrated blended actions, with the 10-year Treasury yield rising to 4.23% and the two-year Treasury yield barely lowering. These fluctuations replicate ongoing market uncertainty and investor sentiment.

Upcoming inflation studies, together with the producer worth index and shopper worth index, will present important insights for Federal Reserve decision-making. Analysts counsel these studies may additional verify or problem present financial coverage expectations.

※ This text summarizes publicly obtainable reporting and is offered for normal info solely. It isn’t authorized, medical, or funding recommendation. Please seek the advice of a certified skilled for choices.

Supply: latimes.com